In 2022, under the impact of the COVID-19, the domestic LED market will decline. It is expected that as economic activities resume, the LED market will also usher in a recovery. Flexible screens and special-shaped screens have a strong market demand. With the progress of Mini/Micro LED technology and superimposed digital China construction environment warm wind, the LED market is expected to achieve continuous growth.

In this issue, we list 4 technical trends and market performances of various links in the display industry in 2023 for your reference and for verification.

1: The LED industry will usher in a new brand pattern

Although the demand will stagnate in 2022, the actions of industrial integration are frequent. According to the forecast of the integration behaviour of key enterprises compiled by authoritative research “2022Q4 LED Industry Quarterly Report”, there is a high probability that this year will usher in a new brand pattern on the chip side, packaging side, and display side.

Changes in control rights of LED-related listed companies in the first three quarters of 2022

Hisense Visual & Changelight

In mid-March, Hisense Visual invested 496 million shares in Qianzhao Optoelectronics. Subsequent holdings increased several times, with a total share capital ratio of 13.29%, becoming the largest shareholder of Qianzhao Optoelectronics.

BOE & HC Semitek

At the end of October, HC Semitek plans to change its control, and specific targets will get 20%-30% of the shares. In May 2021, Huashi Holdings held a 24.87% stake in Huacan Optoelectronics, becoming the company’s largest shareholder

Shenzhen State-owned Assets & AMTC

In May, the controlling shareholder and actual controller of Zhaochi Co., Ltd. was changed to Shenzhen State-owned Assets, with a transfer price of 4.368 billion. after delivery. Capital Group and Yixin Investment hold 14.73% and 5% of the shares respectively

Nationstar Optoelectronics & Yancheng Dongshan

On October 10, Nationstar Optoelectronics planned to purchase a 60% stake in Yancheng Dongshan in cash. If the transaction is completed, Dongshan Precision and Guoxing Optoelectronics will hold 40% and 60% of the equity of Yancheng Dongshan respectively.

Nanfeng Investment & Liantronics

On August 10, Lianjian Optoelectronics issued a shareholding change announcement and the transaction price was RMB 215 million; after the transaction was completed, Nanfeng Investment held 1504% of the shares

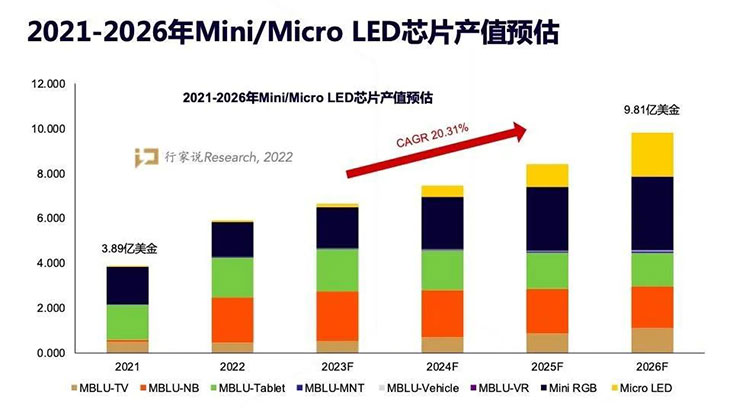

2: The growth momentum of Mini/Micro LED remains undiminished

In 2022, most segments of the industry will perform flat, but Mini/Micro LED will still maintain growth. From the perspective of upstream LED chips, the total output value of Mini LED backlight chips, Mini LED RGB chips and Micro LED chips reached 4.26 billion yuan, a year-on-year increase of about 50%.

Mini/Micro LED chips and application scenarios (2022)

Entering 2023, with the release of epidemic prevention and control, the industrialization process of Mini/Micro LED will be implemented as scheduled.

In terms of the Mini LED backlight, there is already a consensus on a generalized solution, so it is expected to maintain a certain growth in 2023 under the condition of further improvement in cost performance;

In terms of Mini LED RGB, with the increase in shipments and yields, chip prices have dropped to the sweet spot of heavy volume, and the existing high-end LED display products have begun to be replaced. It is expected that the growth momentum in 2022 will be maintained in 2023.

2021-2026 Mini/Micro LED Chip Production Value Forecast

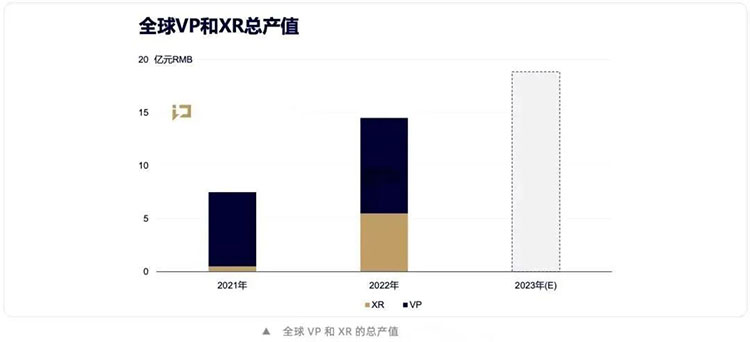

3: Metaverse LED display shines into reality

If we talk about the most discussed word in 2022, it should be “Metaverse”. Various technologies such as immersive computing, edge computing, deep learning, decentralized network, rendering engines, etc. have achieved breakthroughs, gradually bringing human’s bold ideas into reality. Although, at the beginning of this year, chatGPT was obviously stealing the spotlight, which opened up a new round of crazy arms races in the technology world. However, judging from the actual situation of the industry, relevant trends are particularly evident in CES and ISE, the two major exhibitions that the display industry has recently paid attention to. The vast market is advancing.

Global VP and XR total output value

4: The industry returns to the growth track

First of all, from the 2022 performance summary in the “LED Screen Industry Quarterly Report”, it can be seen that the performance of most companies has declined year-on-year.

Performance Forecast of LED and display manufacturers in 2022

Behind the pressure on the performance of many companies is the sluggish market demand caused by the epidemic, which has caused the price and volume to fall in the same direction. Taking the LED display industry as an example, according to the “2022 Small Pitch and Micro Pitch Research White Paper”, the industry’s demand for LED pixels will be nearly 90,000KK/month in 2021, and about 60,000~70,000KK/month in 2022, showing a significant drop in demand. In 2023, domestic epidemic prevention and control will be relaxed, and the policy will focus on economic recovery. On the foreign side, the influence of the monetary policy implemented by the Federal Reserve has declined; then, the two major factors affecting the domestic and foreign economies in 2022 will gradually fade in 2023; it can be seen that the economic recovery will drive the industrial recovery.

It is also worth noting that during the Spring Festival in 2023, various LED companies have already gone overseas to participate in the ISE exhibition, which officially announced the LED industry’s new journey of an “epidemic-free era”.

On the whole, it is a certainty that the industry will return to the growth track. The whole year shows a first decline and then a rise. That is, the first half of the year is under pressure, and the second half of the year is expected to rebound in the recovery. The overall remains cautiously optimistic.

Global LED Display Market Demand Changes

After the COVID-19 epidemic in 2023, the LED market will resume on the right track. XYGLED insists on following the company’s established product route, refines key products, further expands product advantages, and continues to cultivate market segments. The company will in-depth research on LED floor screens, overcome difficulties, solve existing problems in the industry, continue to play the “leadership” spirit, integrate small breakthroughs into big breakthroughs, and achieve the effect of “1+1>2″. After overcoming technical difficulties, XYGLED will apply the new technology to more fields and bring more classic cases. We will not change our original intention and continue to forge ahead!

Disclaimer: Part of the article’s information comes from the Internet. This website is only responsible for sorting out, typesetting, and editing the articles. It is for the purpose of conveying more information, and it does not mean agreeing with its views or confirming the authenticity of its content. , if the articles and manuscripts on this site involve copyright issues, please contact this site in time, and we will deal as soon as possible.

Post time: May-24-2023